Uncover the benefits of inclusive renting and why dropping ‘No DSS’ adverts can lead to long-term success in the property market.

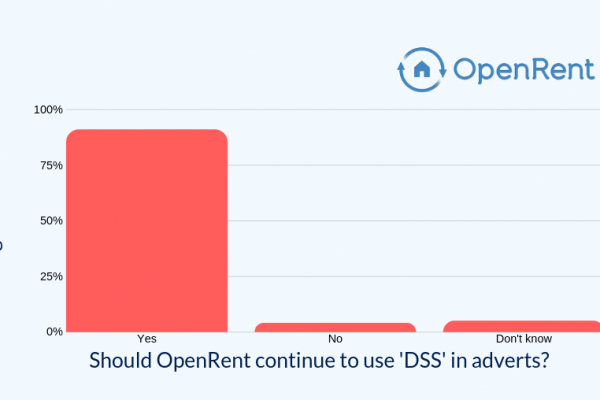

It’s been common for landlords to advertise their properties as ‘No DSS’ (meaning no benefit claimants) in private rentals for quite some time.

However, with upcoming legislation such as the Renters (Reform) Bill and an increase in Local Housing Allowance, you might be contemplating the idea of accepting tenants on benefits.

Explore the advantages of dropping the ‘No DSS’ tag and find practical advice on including tenants who receive benefits when setting up your rental agreements.

- How many renters claim benefits, anyway?

- Three reasons to consider tenants on benefits

- How can landlords reduce risk when renting to tenants on benefits?

Become an OpenRent landlord today and take a proactive role in managing your rentals.

Get Started TodayHow many renters claim benefits, anyway?

According to the English Housing Survey, one in four private rented households reported receiving housing support in 2021-22. While the figure has decreased since the previous term, it may still come as a surprise to many landlords and tenants alike.

Beyond the UK’s student cities and areas with many young professionals, rental markets largely depend on tenants using housing benefits.

This pattern has been growing for decades and seems likely to continue. Since the 1980s, the UK government’s policy has aimed to move people with low incomes from council housing to the private rented sector, subsidising their rent through the housing benefit (initially Local Housing Allowance and now Universal Credit).

Taking into account additional support such as child and disability benefits, it becomes apparent that a substantial number of renters in the UK are recipients of various forms of financial aid.

Three reasons to consider tenants on benefits

While it might seem unlikely to some landlords that a tenant on benefits can afford to rent their property, especially if it’s in the higher price range, excluding them by using ‘No DSS’ in your advert might not be in your best interest.

1. Marketing to a larger pool of tenants

As highlighted earlier, a significant portion of renters receive benefits. In certain areas, excluding all benefit claimants could dramatically reduce the pool of potential tenants for your property.

This not only limits your choices but also reduces the likelihood of finding tenants you’re comfortable renting to.

Additionally, it increases the likelihood of experiencing a void period – a time when your property is unoccupied. The lost rent during this period can quickly become a significant expense.

This issue becomes even more challenging if you depend on your rental income to cover a buy-to-let mortgage or your daily living expenses.

You might also be interested in…

- Maximum Tenancy Deposit: How to Calculate Five Weeks’ Rent

- Going Periodic: What Happens When a Tenancy’s Fixed Term Ends?

- What Does the Renters’ Rights Bill Mean for Landlords?

- DIY Landlord: How to Rent Out Property Without an Agent

- What Are the EPC Requirements for Landlords?

2. Adaptability to market changes

Being open to tenants on benefits showcases a landlord’s flexibility in adapting to changing market dynamics and potential legislative reforms, especially in light of the Renters (Reform) Bill.

In a significant update in November 2023, the government added amendments to the Bill to make it illegal for landlords and letting agents to place blanket bans on tenants who receive benefits or have children.

The government says that this will ensure families and vulnerable people aren’t discriminated against.

While the Bill is only midway through its legislative journey and may not ultimately become law, it’s still important to weigh its potential effects on the rental landscape.

3. Mortgage and insurance terms

There’s a common belief among landlords that renting to tenants on benefits is off-limits due to restrictions in their mortgage agreements or insurance policies. While this may be accurate for some, we recommend confirming with your lender and insurer.

Thanks to a widespread campaign, many banks have adjusted their terms, allowing the renting of properties with buy-to-let mortgages to tenants on benefits.

The same is true for insurers as well, so make sure to review your most recent terms for up-to-date information.

Assess the financial stability and rental history of potential tenants, reducing the risk of late payments or defaults.

Verify Tenants EasilyHow can landlords reduce risk when renting to tenants on benefits?

There’s a common belief that tenants receiving benefits may have a higher risk of falling behind on rent payments.

However, it’s essential to note that this isn’t always true, and a significant majority of tenants on benefits consistently meet their rent obligations, proving to be excellent tenants.

If you’re worried about the possibility of rent arrears, there are several things that you can do as a landlord when setting up the tenancy to protect yourself financially from such situations.

Take the maximum deposit possible

The tenancy deposit can be used to cover arrears at the end of the tenancy. Taking the maximum deposit value possible, currently five weeks’ rent, ensures you will have as much cover as possible against any arrears that accrue.

The tenancy deposit can be used to cover any unpaid rent at the end of the tenancy. By taking the maximum amount possible, which is currently set at five weeks’ rent, you ensure you have extensive coverage against any rent arrears.

Add a guarantor to the contract

You can ask a guarantor to cover any rent that the tenant doesn’t pay. If the tenancy ends with unpaid rent, you have the option to go after the guarantor for those arrears.

Having a guarantor not only gives you another avenue to collect in case of arrears but also lets the tenant know that if they don’t pay, it will impact someone they’re connected to.

Perform referencing checks on all tenants and guarantors

Referencing checks will give you a wealth of information on the tenant and their guarantors, such as their income, credit history and CCJs. All of this information can guide your decision on whom to let to.

Don’t be put off by the fact that tenants claiming benefits are likely to officially ‘fail’ referencing. This occurs because most referencing companies don’t consider benefit income in their affordability calculations.

Instead, examine all the information in the report in its context to make the best decision possible.

Our smart rent collection service is designed to take any awkwardness out of chasing rent payments.

Find Out MoreTake out a rent guarantee insurance policy

If each tenant passes referencing or provides a guarantor who does, you will be eligible to apply for rent guarantee insurance (RGI).

RGI provides coverage against rent arrears in instances where the tenant fails to pay, given that the policy terms are adhered to.

Opt for direct rent payment from the local authority

With the tenant’s consent, you can arrange for their housing benefit to be directly paid to you, the landlord, through an alternative payment arrangement.

If you prefer the assurance of receiving this money directly from the local authority every month, considering this option could be beneficial for your tenancy.