As the UK’s largest letting agent, OpenRent has been asked to contribute to the Work and Pensions Select Committee’s investigation into lettings industry practices around tenants who claim benefits.

We were of course very happy to contribute and our Co-Founder Adam Hyslop will be attending a session to speak to MPs about this important issue.

We know that our users share our concerns about the experience of tenants who claim benefits, so we’d like to share with you our response to Frank Field MP, the Chair of the Committee. We expect the correspondence will soon be live on the Committee’s page on the Parliament website.

Our letter follows.

27th February, 2019

Dear Mr. Field,

Thank you for your letter. I am glad to have the opportunity to answer your questions and discuss these concerns, which we share, with the Committee.

Firstly I would like to begin with an important clarification. In correspondence we have received to date, we are referred to as an “online ad platform” alongside Rightmove, Zoopla and OnTheMarket.

Those companies are property portals, whose customers are letting agents. They allow these letting agents to advertise rental property so that tenants can view many agents’ properties in one place. Portals contract with the agent but not directly with the landlord of the properties they advertise; indeed in most cases the portal will have no contact at all with the landlord of a given property it is advertising.

OpenRent is the UK’s largest letting agent, letting over 100,000 properties a year with a full agency service for landlords spanning property advertising, referencing, tenancy creation, rent collection and many other services. Like other letting agents, our customers are landlords with whom we have a direct contractual relationship. We advertise properties using a wide range of channels including “To Let” boards, local newspaper adverts, our own website, as well as portals like Rightmove and Zoopla.

This distinction is crucial to understanding our approach and policies regarding tenants who claim benefits.

OpenRent is extremely user-centric as a company. We seek to build the best possible service for our landlord and tenant users and have a strong social mission to improve the private rented sector to the benefit of all its participants. As part of this approach we speak to thousands of our users every month in order to understand their needs and adapt our service to meet them.

On the subject of “DSS”, we have additionally worked closely with interest groups and experts to ensure tenants using the site have the best possible experience. We have sought advice and guidance from the Department of Work and Pensions, Local Authorities’ housing team officers and the housing charity Shelter.

In addressing your questions below, I will elaborate on the detail of our approach and the logic behind it.

What is OpenRent’s policy on carrying adverts that contain “No DSS” or similar restrictions?

In general, our policy is to advertise properties with whatever eligibility criteria a landlord sees fit, as long as these are legal. Our intention in doing this is simply to create the best experience for both landlords and tenants.

We are of course sympathetic to the particular frustrations and difficulties faced by people claiming benefits, and as mentioned above, we have collaborated with key stakeholders to ensure we are doing the best we can to support these applicants.

As a result we have made considerable effort to try and address these difficulties as far as possible, and there are several aspects to the problems we are trying to solve, as follows:

Legal status of “DSS” restrictions

As stated above, we do not allow landlords to apply eligibility criteria that are not legal. As such, we would welcome clarification from the Government around advertising properties as “DSS accepted/DSS not accepted”.

I hope it is clear that we would stop supporting use of any criteria if advised that doing so was not legal.

Tenant user experience

OpenRent’s goal is to give all users the best possible experience of the PRS. We let tens of thousands of properties every year, and process millions of property searches every month. To help tenants quickly find suitable properties, we allow landlords to tag properties with attributes like “Pets allowed”, “Students only” or “DSS available”.

Tenants are able to use these tags to filter search results and find suitable properties quickly. From there they are able to make their application to the landlord which typically includes a discussion around the tenant’s specific circumstances and requirements. If they wish to apply for properties where the landlord has indicated that they are unable to accept “DSS” tenants, then they are still able to do this.

With the legislation as it currently is, i.e. with advertising “DSS not accepted” understood not to be unlawful, OpenRent’s stance is that it is better to be upfront with ‘“DSS” tenants about which landlords would consider their enquiries. We believe that removing the “DSS” search filter would only force users to waste hours applying to dozens of properties, only to be rejected from the vast majority, causing further frustration and disappointment.

Landlord preferences

Our landlord customers always have the final decision on which tenant to accept for their property. With regards to the “DSS” issue, we see three main challenges on the landlord side:

i) Many landlords have existing contractual obligations preventing them from letting to benefit claimants. These include the terms of mortgages, insurance policies, agreements with superior landlords, and many others. If a landlord tells us they are contractually prohibited from letting to a particular tenant then our view is that it makes no sense for us to introduce that tenant to them. To do so would simply mismanage expectations and waste time, money and energy on both sides.

I understand that relevant parties will be submitting detailed evidence on these factors, which we believe to be the heart of this issue and as such need to be better understood. If these contractual restrictions were voluntarily removed or prohibited, then overnight, a much larger proportion of properties we advertise would be able to welcome DSS applicants.

ii) A related issue to (i) is that industry standard referencing does not accommodate benefits claimants particularly well. This means that landlords putting these applicants through referencing will often see a “fail” outcome, and be ineligible to take out rent guarantee insurance. We have been trying hard (over a period of several years) to work with insurers to extend their acceptance criteria, but appetite to do so has been limited.

Recently we have made some good progress in this area and believe we can continue to drive further innovation. As it currently stands, however, many landlords are in a position where they have to accept an inability to insure their rental income if they let to people who claim benefits.

iii) Other landlords have preconceptions about letting to tenants who claim benefits. Some of these may be a misunderstanding of their contractual obligations, e.g. landlords incorrectly believing that their mortgage or insurance policy restricts this. Others may have previously used a letting agent who had a blanket “No DSS” policy (which Shelter have told us is quite common) and are now continuing this practice. Finally, some landlords perceive that letting to benefit claimants is higher risk.

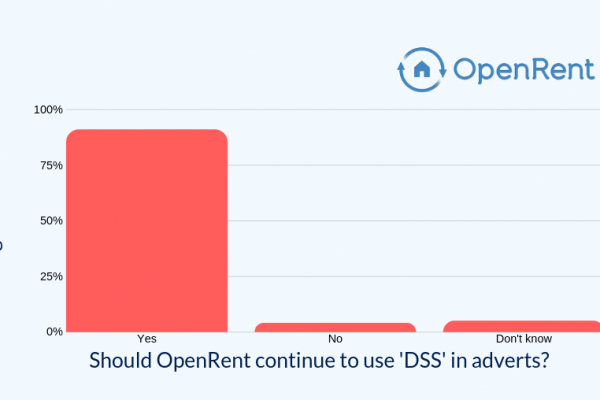

In this situation, we have seen an opportunity to do better for all parties. On OpenRent, restrictions are by default all set to their least exclusive settings, with landlords having to actively choose to make their property “DSS not available”. We then actively encourage landlords to consider all tenants on their individual merits, describing the advantage of being open to enquiries from as many tenants as possible, and supporting this with data, content and advice on the subject.

Results

OpenRent advertised 17,000 ‘DSS accepted’ properties in 2018, which we understand to be the largest number of any UK letting agent. OpenRent is, to my knowledge, the only letting agent in the UK where tenants claiming benefits can search over 1,000 live properties across the whole of the UK that explicitly advertise that the landlord welcomes their enquiry. This means tenants can avoid spending hours writing cover letters pleading their case, and instead can engage with those properties knowing that they will be considered.

As well as the large total number, we also believe that the proportion of properties advertised on OpenRent whose landlords have ticked ‘DSS accepted’ is also much higher than the industry average. Many local authorities refer tenants to us specifically because our search allows them to more easily find suitable properties, and we are regularly recommended by consumer journalists at national publishers and major newspapers for our treatment of tenants.

What steps, if any, does OpenRent take to ensure that lettings agents using the service do not post adverts that discriminate against benefit claimants? What steps does OpenRent take if such an advert comes to light?

Given the nature of OpenRent’s services, described above, these two questions do not seem applicable since we are a letting agent ourselves. We would be very happy to answer further questions if the Committee would like to explore other areas or follow up on any of our comments.

I hope these responses are useful to your work on this important issue and we look forward to the outcome of your investigation.

Best wishes,

Good to see your submission to Frank Field Sam, and to know that these discussions are happening. Problems re late payment of DSS because that is how their system is set up doesn’t seem to have been put to Frank? If they could correct that I think there would be a greater uptake of DSS applicants, who in many ways should be guaranteed payers.

Maybe in your final paragraph you meant to say you were NOT a letting agent?

Would a bank give loans to people who cannot repay it. Of course not. This is no different. A lot of money has gone into a rental property and the government offer absolutely no protection to the landlord without the landlord having to fork out a fortune to get possession of his/her property. If they fail referencing or I can’t get rent guarantee then I will not let them the property and if I am forced to go down this route I will sell it and the government can follow their own legislations and house them. At the end of the day people are responsible for their own destiny and it should not be forced on me. Landlords are not social caretakers we are businesses. If they couldn’t afford to pay for food from a supermarket should the shop let them have the food and trust they will pay later. Of course not. The rental business is no different and should not be discriminated against in this way. I lost a lot of money on my first venture because of a DSS tenant and I will not go down that route again.

Hi Sally, Good point about late payment.

That (along with how housing benefits have been frozen/not keeping up with rents since 2010) is something we think is a big part of the reason why many landlords have a preference to let to people with an earned income.

I didn’t mention it in the letter because many companies/organisations received questions from the Committee, and I trust that some of those other respondents are better placed to make those points. We just answered the questions that Frank Field MP asked us, which on this occasion didn’t include general thoughts on the benefits system.

Im sure that other groups, e.g. Citizens Advice will be bringing it up with lots of evidence to back it up!

Sam

When the goverment decided to pay tenants the housing benefit to the tenant I stoped taking on this type of tenant. , and never will do. you get paid in arrears , if they make a false claim their money will be stopped and the landlord wont get any rent. they can recnde their agreement to have it paid direct to you. If it is paid direct, the local council will sieze any excuse to get it back off the landlord if the tenant has been “naughty” Its a minefield DO NOT ENTER.